How to Create a Personal Budget That Actually Works

Living paycheck to paycheck? Struggling to keep track of your spending? You’re not alone. A personal budget is one of the most effective tools to gain financial control, reduce stress, and start building wealth. But the truth is — most people create budgets they can’t stick to.

In this guide, we’ll show you how to create a practical, easy-to-follow budget that actually works for your lifestyle. Whether you’re a student, full-time employee, or freelancer, these budgeting strategies will help you take charge of your money — once and for all.

Why Most Budgets Fail

Before we build a working budget, let’s address why most don’t stick:

- They’re too restrictive — like a financial diet you can’t sustain

- They don’t account for unexpected expenses

- They don’t align with your actual spending behavior

The key is to create a system that reflects your reality — not one based on guilt or perfection.

Step-by-Step: How to Build a Budget That Works

1. Know Your Numbers

Track your income and expenses over the last 1–2 months. Use a budgeting app like YNAB, Mint, or EveryDollar — or a simple spreadsheet works too.

Track These:

- Income: Salary, side hustle, benefits, etc.

- Fixed expenses: Rent, insurance, loan payments

- Variable expenses: Groceries, transport, entertainment

- Irregular expenses: Annual fees, holidays, birthdays

2. Choose a Budgeting Method

Here are three proven methods you can try:

🟠 50/30/20 Rule

- 50% Needs (rent, food, utilities)

- 30% Wants (dining out, shopping, subscriptions)

- 20% Savings & Debt Repayment

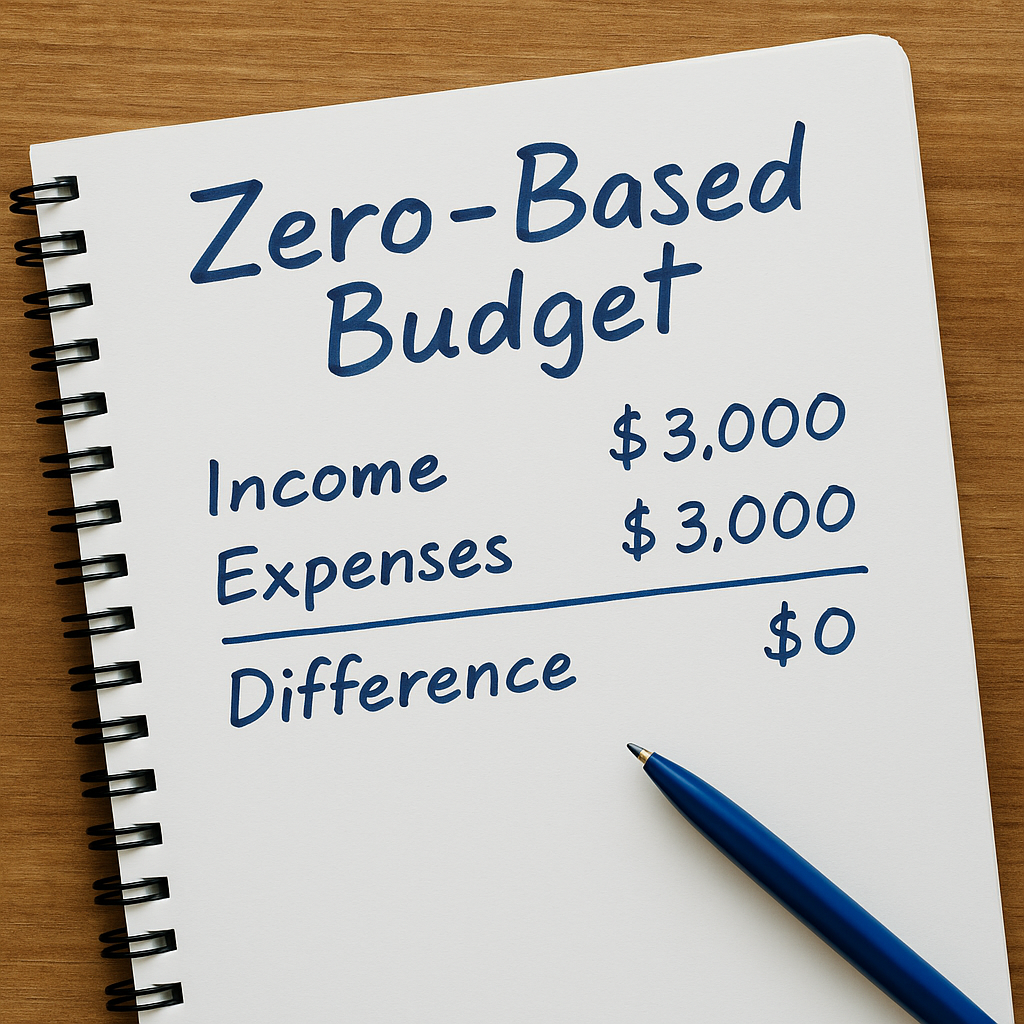

🟢 Zero-Based Budget

Every dollar gets assigned a “job.” Income minus expenses should equal zero. Ideal for detailed planners.

🔵 Pay-Yourself-First

Automate savings first, then budget with what’s left. Great for building emergency funds or retirement savings.

3. Categorize & Set Spending Limits

Break down your expenses by category and assign realistic limits based on your spending history. Example:

| Category | Monthly Limit |

|---|---|

| Groceries | $500 |

| Transportation | $150 |

| Dining Out | $100 |

| Emergency Fund | $200 |

4. Automate What You Can

Set up automatic transfers to savings accounts, investment platforms, or bill payments. Automation removes the temptation to spend before saving.

5. Review & Adjust Monthly

Budgeting is not a one-and-done deal. Review your progress monthly, look for overspending trends, and adjust limits as life changes.

Common Budgeting Mistakes to Avoid

- ❌ Forgetting irregular expenses

- ❌ Setting unrealistic spending limits

- ❌ Budgeting based on your ideal self, not your current self

- ❌ Not tracking progress

Budgeting Tools Worth Trying

- YNAB (You Need a Budget)

- Mint

- EveryDollar

- Google Sheets (Free templates available)

Final Thoughts: Small Wins Lead to Big Change

Creating a budget that actually works doesn’t mean giving up what you love — it means being intentional with your money. Whether you use the 50/30/20 rule or a zero-based budget, the most important part is consistency. The more you practice budgeting, the more confident and financially secure you’ll become.

Start small. Stick with it. Watch your money grow.